Superfund lending

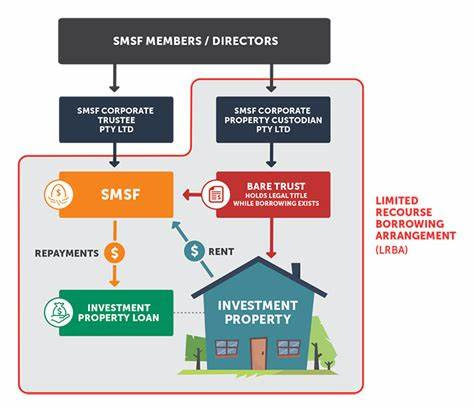

Are you looking for a way to diversify your superannuation portfolio and achieve your retirement goals? Have you considered self-managed superfund lending? First things first, any decision around this or discussion must be held with a financial planner and your accountant, the right advice is paramount to ensure you stay compliant to the laws that sit around SMSF lending. Self-managed superfund lending is a type of investment loan that allows your SMSF to use its funds as a deposit to purchase an investment property and borrow the remaining amount required to fund the purchase. This can allow your SMSF to invest in properties that it may not otherwise have the funds to immediately purchase. The benefits of SMSF lending include: Potential capital growth and rental income from the property Tax advantages such as deductions for interest and depreciation, and lower capital gains tax rate. Greater control and flexibility over your superannuation investments Ability to leverage your sup...